VCS Invoice Compliance

VAT Calculation Service (VCS) invoice compliance

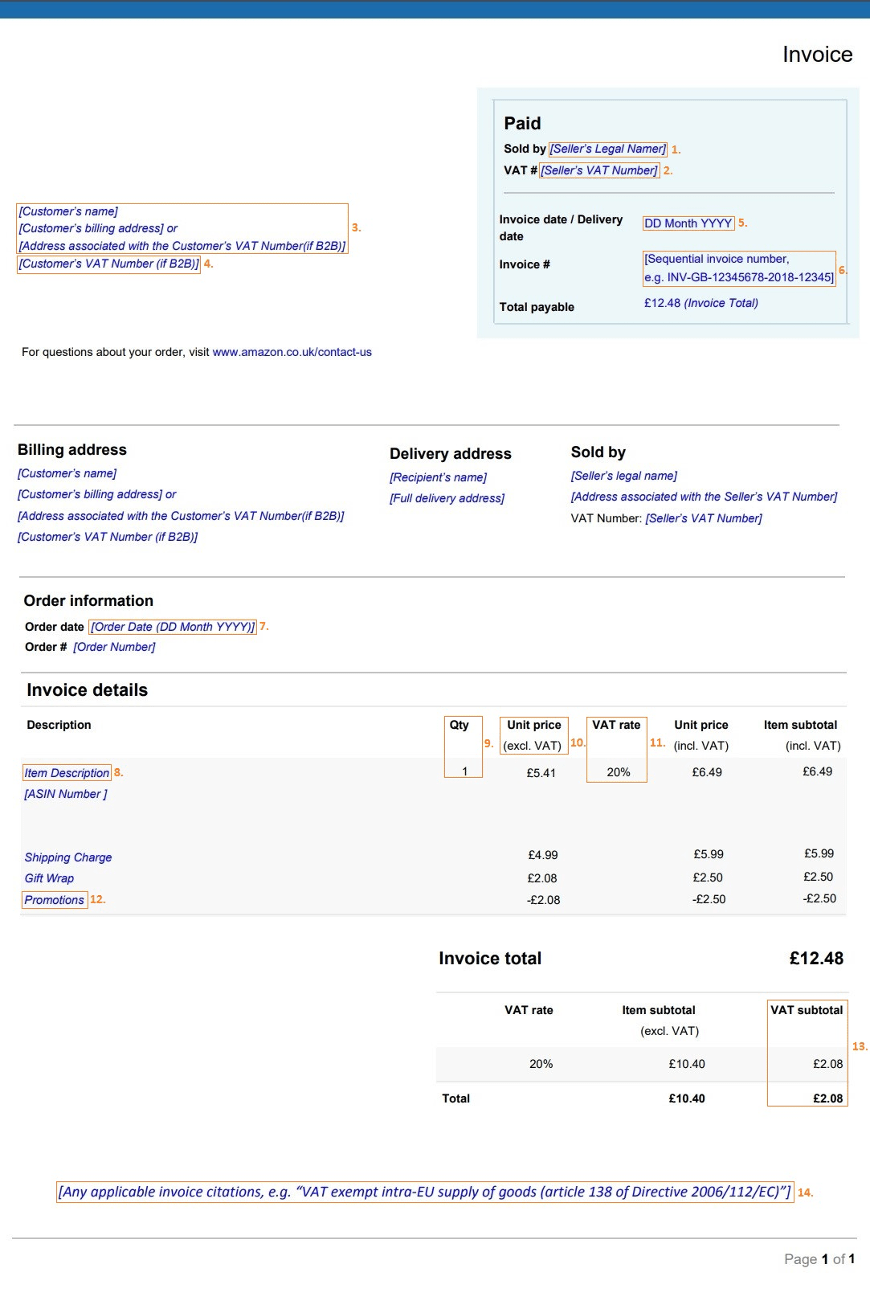

VAT invoices must comply with applicable laws. At minimum you must include the following information on the invoice:

-

Registered company name and address of the seller

-

VAT identification number of the seller (if applicable)

-

Complete official name and address of the customer

-

VAT identification number of the customer

-

This is only necessary if the customer is responsible for the tax in the purchase order (for example, for intra-community delivery or reverse charge procedures).

-

This number is provided in the VIDR.

-

-

Invoice date/service date

-

Invoice number

-

Order date

-

Product name

-

Purchase quantity

-

Unit price of the item (without VAT)

-

VAT rate applied

-

Discounts/promotions, if not included in the unit price

-

VAT amount

-

Citation

Sample invoice

The sample invoice format is only for guidance. You can choose the format, logo. Follow these best practices for a positive customer experience and a trouble-free process:

-

Do not include bank details, to avoid direct bank transfers to you.

-

Do not include payment status, such as paid/not paid.

-

Provide order-related fields (for example, order number, product category, Purchase Order number).

For further information, contact your tax advisor.

Updated 6 months ago